Financial Reports Vs Management Reports

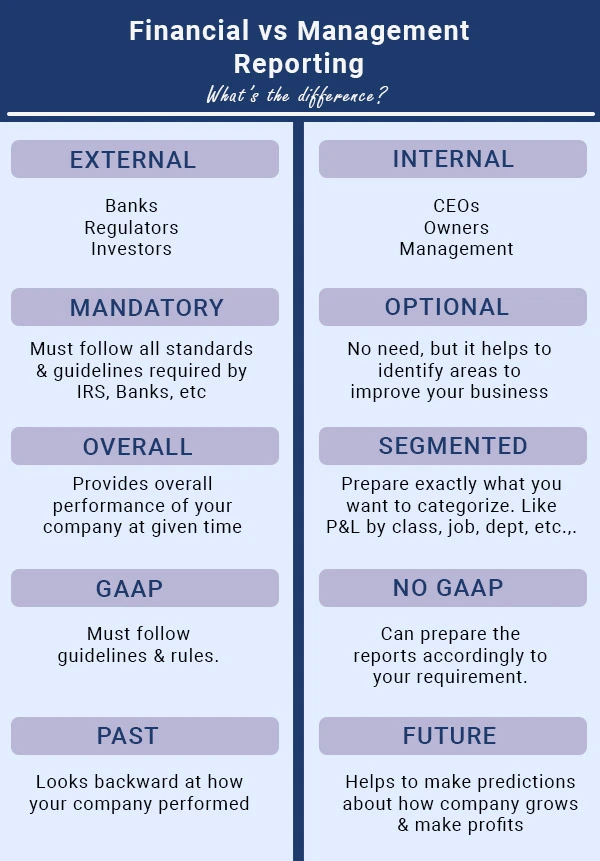

Financial reports are a standard accounting practice using financial statements to disclose a company’s financial information and performance over a particular period, usually on an annual or quarterly basis. On the other hand, management reports involve the process of providing information to various levels of management. This enables judging the effectiveness of their responsibility centers and becomes a base for taking corrective measures as and when necessary.

Purpose of Financial Reports and Management Reports

In simple terms, financial reports are used for external purposes to understand the company’s brief overall performance. It involves the disclosure of financial knowledge to the company’s various stakeholders, emphasizing the company’s financial performance and financial position. Only with the help of financial reports and an understanding of the company’s financial health can the management make informed business-related decisions.

On the other hand, management reports are used for internal purposes to selectively gain information on the company’s categorial operations. In this system, each operations manager receives a well-structured list of information. It is the only basis for decision making whenever necessary. Executive reports are designed to provide detailed insights into a company’s performance.

Key Objectives of Financial Reports

- Financial reports are meant to follow Generally Accepted Accounting Principles (GAAP). GAAP is a common set of accounting rules and procedures that companies should use for an organized and transparent compilation of their financial statements.

- Financial reports are required to provide information to the organization’s management for planning, analysis, and decision-making purposes.

- Investors, promoters, debt providers, and creditors are enabled to make rational and prudent decisions about credit, investment, and other matters.

- This type of report provides knowledge about the organization’s economic resources, how they are being used, claims to the resources, and how the claims have changed over a certain time period.

- Providing information to the statutory auditors, which in turn facilitates audits.

- The company stakeholders are informed regarding the performance management of an organization as to how diligently and ethically they are discharging their fiscal duties and responsibilities.

- Social welfare is enhanced, and the interests of employees, trade unions, and the government are considered.

Key Objectives of Management Reports

- Management reports do not necessarily need to follow the Generally Accepted Accounting Principles (GAAP). The company can produce reports based on their convenience.

- Management reports are used as a means of upward communication, where the prepared report is submitted to an operational department manager and is someone who needs the particular information for carrying out certain managerial functions.

- They serve to be records, providing valuable and important references in the future. Some reports are prepared to satiate the legal requirements.

- Management reports are generally of concern to the top management executives, government agencies, shareholders, creditors, customers, and the general public. Multiple types of management reports are prepared to reassure the above-mentioned interested parties.

- General progress reports on the business and the use of company’s resources are prepared and presented to the public, which helps increase the company’s goodwill and develop public relations.

- Management reports also act as a basis to measure performance, where each employee’s performance is prepared in a report format. At times, it is also formed on the basis of a group or department. These performance reports are used for promotion and incentive purposes or for giving bonuses.

- Based on management reports, actions are initiated and instructions are provided to improve performance in certain aspects.

Examples of Financial Reports

There are five types of basic financial reports used by a company.

- Balance sheet – A balance sheet is a financial statement that provides an overview of a company’s financial position at any point. It consists of three main sections – assets, liabilities, and shareholders’ equity.

- Income statement – An income statement is also known as a profit and loss statement, as it summarizes a company’s revenue, expenses, and net income over a specific time period.

- Cash flow statement- A cash flow statement is a financial statement showing how any change in a balance sheet account and income affects the cash and its equivalents. This statement breaks the analysis down to its operation, investment, and financial activity, providing insights into a company’s liquidity.

- Changes in Capital statement- This statement refers to changes in a company’s capital structure in a time period. It includes details on any issuances or repurchases of shares, changes in debt levels, or dividends paid to shareholders of the company- basically, anything affecting the company’s capital.

- Notes to Financial statement- These offer even further details about the company’s accounting methods, assumptions made, and any other significant event or information. This is prepared to help users better understand the company’s financial performance and financial position.

- Profit or Loss Statement

- Accounts Payable

- Accounts Receivable

Examples of Management Reports

For instance, a manufacturing company can primarily use two types of management reports, which are further broken down into sub-reports.

Purpose reports

- Informational reports – These reports will provide factual data and brief summaries on certain sections of the manufacturing company’s work.

- Analytic reports – These are better in-depth KPI (key performance indicator) reports that compare trends and provide insights to explain the company’s working and segregating areas of improvement.

- Operational reports – With this, one can track regular, weekly, or even monthly performance aspects of specific operations.

- Goal-oriented reports – These kinds of reports can help the manufacturing company create and evaluate long-term strategies and goals, identifying potential downfalls or opportunities.

- Profit and loss (by category, team, job, or department)

- Inventory reports

- Sales reports

- Marketing Reports

Formal Reports

- Statutory reports – Statutory reports follow the rules of a higher authority, mostly a government agency. They are required to provide details of benefits provided to their employees and the company’s profit and loss operations.

- Voluntary reports – Unlike statutory reports, these reports are not bound by any legal form. They help formulate administrative policy and aid in management decision-making aspects.

Does a Business Need Financial Reports and Management Reports?

The answer to this question is quite simple. Yes, any company, whether manufacturing, logistics, or any other, needs financial and management reports. Each serves a significant purpose and must not be overlooked. If either one is solely focused upon, management may miss out on crucial information that could help their business prosper or be lured into implementing unnecessary, expensive programs.

Learn More:

- What’s the meaning of OEM, ODM, & After Market? Definitions & Examples

- How To Conduct a Market Analysis For Your Business

- What is PEST & PESTLE analysis? Definitions, Examples & Free Templates;

- How to conduct PEST or PESTLE Analysis: Advantages & Limitations;

- PEST or PESTLE Analysis for an OEM? What are it’s advantages?

- What is SWOT Analysis & How to Perform It? Advantages & it’s Limitations