What is the meaning of recession?

In normal parlance, a recession is a pecuniary incident with negative implications on economic activity. It usually lasts for months or in some cases even years. A recession is officially acknowledged when a nation’s economy experiences negative gross domestic product (GDP). The situation is usually compounded by rising unemployment, falling retail sales and other such phenomenon. Contracting measures of income and manufacturing for an extended period of time is yet another firm indicator.

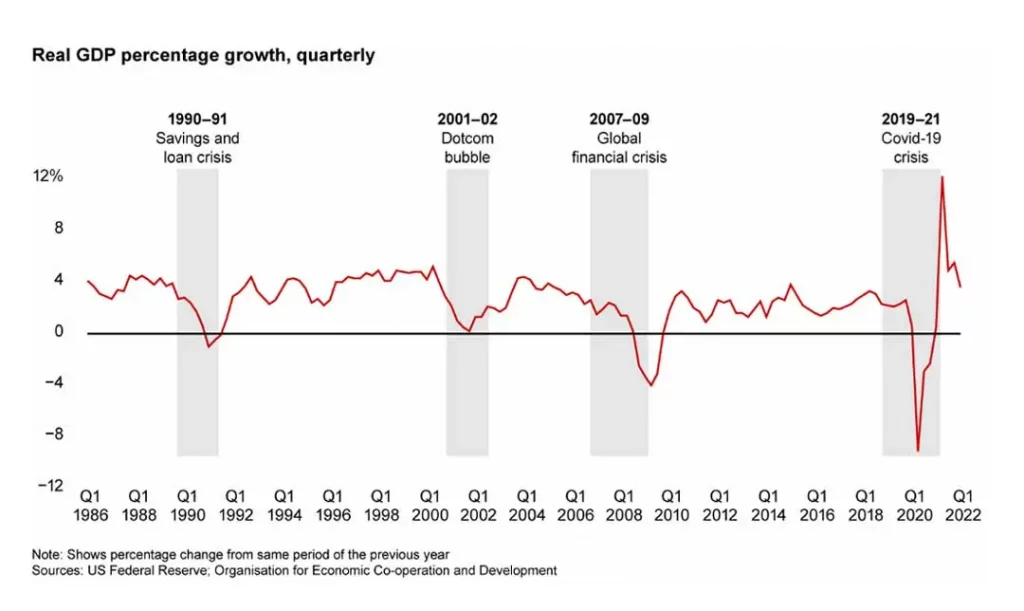

Recessions are an inevitable part of any business cycle; it’s the regular cadence of expansion and contraction that takes place periodically in a nation’s economy. To put it in a nutshell, a recession triggers economic struggles, unemployment, market sales slump and the decline of a nation’s overall economic output. The most popular definition of a recession was put forward by economist Julius Shiskin in 1974. As per the theory, two consecutive quarters of declining GDP signal the advent of recession. This definition has been accepted as a common standard over the years.

Factors that trigger recession

An abrupt shock effect on the economy: It is a surprise problem that creates serious fiscal damage. The COVID19 pandemic, which shut down economies worldwide, is a recent example of a typical shock to the global economy.

Excessive debt: Businesses taking on too much debt often find the cost of servicing the same cumbersome. It generally peaks when they default on regular pay-outs leading to bankruptcy. The dot com bubble burst in the mid-aughts causing the Great Dot Com Recession is a relevant example.

Asset bubbles: Impulsive investing decisions generally lead to bad economic outcomes. An over optimistic approach during a strong economy is often the starting point. The disproportionate gains in the stock market (In India) in the late 80s and 90s driven by ‘irrational exuberance’ is a good example. It temporarily inflated the markets, ultimately leading to popping of the bubble which in turn caused panic selling. The net result was a spectacular market crash, causing a recession.

Too much inflation: General inflation is manifested in the form of steady, upward trend in prices over time. It’s a normal phenomenon; yet excessive inflation could be dangerous. Central banks usually control inflation by raising interest rates, as higher interest rates deplete economic activity. But excessive raise in the interest rates causes a recession.

Technological change: Techno-powered innovations tend to increase productivity, reinforcing the long-term economy; but there are bound to be short-term periods of resistance to technological breakthroughs leading to recession. The industrial revolution of the 19th century rendered entire professions obsolete, sparking recessions and hard times. In the contemporary scenario, AI and robotic functionality could cause recessions by eliminating human intervention in business operations.

Too much deflation: Deflation takes place when prices decline over time, triggering wage cuts, which further depresses prices. During deflation phases spending by people and enterprises is directly impacted undermining the economy.

Recession may be incoming

The world is all set to experience a new wave of financial uncertainty unleashed by the recession which is soon going to hit the global economy as per fiscal experts. But this recession will be different considering the dynamic socio-economic and geo-political equations prevalent. The contemporary times are witnessing decision makers struggling to navigate through the onslaught of major disruptions which never existed during previous recessionary periods. Several critical factors like supply chain constraints, geopolitical tensions (Russia-Ukraine conflict), an unprecedented labour shortage, the aftermath left by a global pandemic (COVID19) and the inevitability of inflation even amid recession are combining to create what can be termed as the first stagflation scenario since the 1970s. To put it briefly, recessions are a certainty of life. It’s just that the timing and extent are hard to predict.

Recession and the manufacturing sector

Like every other enterprise sector, the manufacturing spectrum too is not insulated against recession. In fact, manufacturers may be more vulnerable to a recession and may end up losing more as compared to other industries. For example, during the Great Recession, 4 in every 10 companies filing for bankruptcy pertained to the industrial manufacturing sector. Yet manufacturing concerns can embrace a host of measures to successfully navigate through the uncertainty unleashed by recession. To experience stability during the recovery phase, manufacturers must recalibrate strategies pertaining to global supply chain management and hiring needs for meeting increasing demand. It is imperative to perform due diligence and identify potential supplier issues for timely solutions.

Building new regional supply chains will enable manufacturers to mitigate risks caused by global disruptions and drive economic growth in their communities. Manufacturing entities must implement automations to accelerate production capabilities in periods of dynamic demand. Automation optimizes the efficiency of manufacturing environments, facilitates cost savings, elevates safety conditions and amplifies production. This in turn results in the revenue growth necessary to sustain during periods of recession.

Talent and the future of work is a high-impact disruptive factor influencing the outcomes across manufacturing spectrum. Hiring should be a top priority to match economic demand during and after recession. Strategic initiatives for talent acquisition must be deployed to ensure capacity can be met to counter the effects of economic recession. It is mandatory for manufacturing firms to undertake rapid hiring for quality talent acquisition in times of fiscal uncertainty.

The bottom line

Desperate times need desperate measures where complacency is not an option. To emerge successfully from a fiscal catastrophe, the manufacturing sector must focus on supply chain disruptions and labour shortages from a brand-new perspective. Supply chain restructuring, process automation and hiring could be the critical success factors crucial to the sector’s ability to negate adversity. It also has influence on the national and global economies.

Also Read:

- Tire Market: The Global Tire Industry Analysis

- NAFTA: North America Free Trade Agreements And Its Benefits in Global Market

- Starting a new Plastic Manufacturing Company? Here is your checklist.

- Auto OEMs to Invest $515 Bn in EV Technologies and Upgrades

- How to Turn Ideas into Successful Startup Firms